Sales Tax NYC: 7 Shocking Facts You Must Know in 2024

Navigating the world of sales tax in NYC can feel like decoding a secret code. With layered rates, hidden surcharges, and confusing exemptions, it’s easy to overpay. Let’s break it down—clearly and completely.

Sales Tax NYC: The Basic Framework Explained

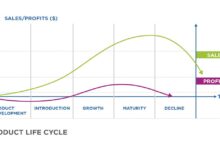

Understanding the foundational structure of sales tax in New York City is the first step toward financial clarity for both consumers and businesses. Unlike a flat, simple rate, NYC’s sales tax is a composite of multiple levies imposed by different government tiers. This layered system means the final rate you pay at checkout isn’t just one tax—it’s a combination of state, city, and sometimes special district taxes.

What Is Sales Tax and How Does It Apply in NYC?

Sales tax is a consumption tax imposed by the government on the sale of goods and services. In New York City, this tax is collected at the point of sale by retailers and later remitted to the New York State Department of Taxation and Finance. The tax applies to most tangible personal property and certain services, though numerous exemptions exist.

sales tax nyc – Sales tax nyc menjadi aspek penting yang dibahas di sini.

According to the New York State Department of Taxation and Finance, the base sales tax rate in NYC is 8.875%. This rate is not arbitrary—it’s the sum of several components: 4% state tax, 4.5% city tax, and an additional 0.375% Metropolitan Commuter Transportation District (MCTD) surcharge. This makes NYC one of the highest-taxed major cities in the United States for retail purchases.

Who Collects Sales Tax in NYC?

The responsibility for collecting sales tax falls squarely on the shoulders of retailers. Any business that sells taxable goods or services in New York City must register with the state, collect the appropriate tax from customers, and file periodic returns. Failure to comply can result in penalties, interest, and even legal action.

Retailers must register for a Certificate of Authority via the NYS Tax Department’s online portal.Marketplace facilitators like Amazon or Etsy are now required to collect and remit sales tax on behalf of third-party sellers, thanks to economic nexus laws.Non-resident businesses selling into NYC may also be liable if they meet certain sales thresholds.

sales tax nyc – Sales tax nyc menjadi aspek penting yang dibahas di sini.

.”All sellers, whether brick-and-mortar or online, must collect sales tax if they have nexus in New York State.” — NYS Department of Taxation and Finance

Breaking Down the 8.875% Sales Tax NYC Rate

The widely cited 8.875% sales tax rate in NYC is actually a composite number.It’s essential to understand its components to grasp why prices feel higher in the city compared to other parts of the state or country..

State Sales Tax Component (4%)

The New York State government imposes a base sales tax rate of 4% on most taxable sales. This portion funds state-level programs such as education, transportation, and public safety. While 4% may seem modest compared to other states, it’s just the starting point in NYC.

This rate applies uniformly across the state, but in NYC, it’s combined with additional local taxes, making the total burden significantly higher. For context, counties outside NYC may only add 3-4% in local taxes, resulting in a total rate of around 7-8%, still lower than the city’s 8.875%.

sales tax nyc – Sales tax nyc menjadi aspek penting yang dibahas di sini.

NYC Local Sales Tax (4.5%)

The City of New York adds a 4.5% local sales tax on top of the state’s 4%. This revenue supports municipal services such as sanitation, public libraries, and local infrastructure. The city tax is one of the highest local rates in the nation and reflects the high cost of urban governance.

It’s important to note that this 4.5% applies only within the five boroughs: Manhattan, Brooklyn, Queens, The Bronx, and Staten Island. Residents of Long Island or Westchester County pay lower local rates, even though they are part of the broader New York metropolitan area.

MCTD Surcharge (0.375%)

The Metropolitan Commuter Transportation District (MCTD) surcharge of 0.375% is an additional fee that applies in NYC and certain surrounding counties. This tax was established to fund the Metropolitan Transportation Authority (MTA), which operates the subway, buses, and commuter rails.

sales tax nyc – Sales tax nyc menjadi aspek penting yang dibahas di sini.

The MCTD surcharge applies not only to retail sales but also to restaurant meals, hotel stays, and car rentals. This means that even services are subject to the full 8.875% rate in many cases. For travelers, this can be a surprise when reviewing hotel bills or dining receipts.

What Goods and Services Are Taxable in NYC?

While many items are subject to the full 8.875% sales tax NYC rate, the rules around what is taxable—and at what rate—can be complex. Some goods are taxed at reduced rates, while others are completely exempt.

Taxable Goods: From Clothing to Electronics

Most tangible personal property sold at retail is subject to sales tax in NYC. This includes:

sales tax nyc – Sales tax nyc menjadi aspek penting yang dibahas di sini.

- Clothing and footwear priced over $110 (more on this exemption below)

- Electronics such as smartphones, laptops, and televisions

- Furniture, appliances, and home goods

- Prepared food and restaurant meals

- Alcohol, tobacco, and vaping products

Notably, restaurant meals are fully taxable at 8.875%, unlike groceries, which are generally exempt. This distinction is crucial for both diners and restaurateurs. The tax applies to all food consumed on-premises or taken out, including delivery orders placed through apps like DoorDash or Uber Eats.

Services Subject to Sales Tax NYC

Traditionally, services are not taxed in many states, but New York is an exception. Certain services are deemed “taxable” if they involve the transfer of tangible property or are closely tied to a physical product.

Examples include:

sales tax nyc – Sales tax nyc menjadi aspek penting yang dibahas di sini.

- Installation and repair services for taxable items (e.g., TV mounting, appliance repair)

- Photocopying and printing services

- Service plans and warranties sold with electronics

- Salon services that involve products (e.g., hair coloring with chemicals)

However, purely personal services like legal advice, medical care, or accounting are not subject to sales tax. The line can be blurry, so businesses should consult the NYS Tax Department’s guide on taxable services for clarity.

Common Exemptions and Reduced Rates

New York offers several exemptions to ease the tax burden on essential goods and services. The most well-known is the clothing exemption:

- Clothing and footwear under $110: These items are exempt from both state and local sales tax. This means a $100 pair of sneakers is tax-free, but a $115 jacket is taxed on the full amount, not just the excess.

- Groceries: Unprepared food for home consumption is exempt from sales tax. This includes bread, produce, meat, and dairy. However, hot prepared foods (like rotisserie chicken) are taxable.

- Prescription medications: All prescription drugs are exempt. Over-the-counter medications, however, are taxable unless prescribed by a doctor.

- Periodicals: Newspapers and magazines are exempt, though digital subscriptions may be treated differently.

These exemptions are designed to reduce the regressive impact of sales tax on low- and middle-income households.

sales tax nyc – Sales tax nyc menjadi aspek penting yang dibahas di sini.

Sales Tax NYC for Online and Remote Sellers

The rise of e-commerce has transformed the sales tax landscape. What used to apply only to local stores now extends to online retailers across the country, thanks to a landmark Supreme Court decision.

Economic Nexus: The Game-Changer for Online Sales

In 2018, the U.S. Supreme Court ruled in South Dakota v. Wayfair, Inc. that states can require out-of-state sellers to collect sales tax even without a physical presence, as long as they meet certain economic thresholds. New York was quick to adopt this standard.

Under New York’s economic nexus law, any remote seller (including online marketplaces) must collect and remit sales tax if they have:

sales tax nyc – Sales tax nyc menjadi aspek penting yang dibahas di sini.

- More than $500,000 in annual sales into New York State, AND

- At least 100 separate transactions in the state during the previous calendar year

This rule applies regardless of whether the seller has a warehouse, office, or employee in NYC. It has significantly expanded the tax base and ensures that local businesses aren’t disadvantaged by out-of-state competitors.

Marketplace Facilitator Laws in NYC

New York also enforces marketplace facilitator laws, which shift the tax collection burden from individual sellers to the platforms they use. This means that if you sell on Amazon, Etsy, or eBay, the platform is responsible for collecting and remitting sales tax on your behalf—provided they meet the nexus criteria.

This law simplifies compliance for small businesses and ensures greater tax fairness. However, sellers must still monitor their own sales to determine if they exceed thresholds independently.

sales tax nyc – Sales tax nyc menjadi aspek penting yang dibahas di sini.

How to Register for Sales Tax as an Online Seller

If you’re an online seller meeting the economic nexus thresholds, you must register for a Certificate of Authority with the NYS Tax Department. The process is fully online and includes:

- Creating an account on the NYS Tax Online Services portal

- Providing business details, including EIN or SSN

- Selecting the appropriate tax types (e.g., Sales Tax, Use Tax)

- Setting up filing frequency (monthly, quarterly, or annually based on volume)

Once registered, you’ll receive a sales tax certificate and must begin collecting tax from NYC customers immediately.

Special Cases: Hotel, Car Rentals, and Dining Taxes

While most people think of sales tax in terms of retail shopping, NYC imposes additional taxes on transient services like lodging and transportation. These are often layered on top of the standard 8.875%, making them some of the highest in the nation.

sales tax nyc – Sales tax nyc menjadi aspek penting yang dibahas di sini.

Hotel Occupancy Tax in NYC: More Than Just Sales Tax

Visitors staying in NYC hotels face a complex web of taxes. In addition to the 8.875% sales tax, they must pay:

- 4.5% NYC Hotel Occupancy Tax

- 3.5% State Occupancy Tax

- $2.00 per night Metropolitan Commuter Transportation Surcharge

- $1.50 to $3.50 per night Additional Room Occupancy Tax (based on room rate)

For a $300-per-night hotel room, these taxes can add up to over 18% of the base rate. The NYC Department of Finance provides a detailed breakdown for transparency.

Car Rental Taxes: A Hidden Cost for Tourists

Renting a car in NYC comes with multiple surcharges:

sales tax nyc – Sales tax nyc menjadi aspek penting yang dibahas di sini.

- 8.875% sales tax on the rental rate

- 12% Metropolitan Commuter Transportation District surcharge

- 8% Rental Car Tax imposed by NYC

- $0.50 per day Clean Air/Clean Water Fee

- $2.50 per day Congestion Mitigation Fee (in certain zones)

These fees can double the effective tax rate on a rental, making it one of the most heavily taxed services in the city.

Dining and Restaurant Tax Rules in NYC

Every meal eaten at a restaurant in NYC is subject to the full 8.875% sales tax. This includes:

- On-premise dining

- Takeout and delivery

- Catered events

- Tips (though tips themselves are not taxed, the total bill including tip is used to calculate tax on the meal)

Unlike some states, NYC does not differentiate between “dine-in” and “takeout” for tax purposes. However, if you buy unprepared groceries from a supermarket, no sales tax applies.

sales tax nyc – Sales tax nyc menjadi aspek penting yang dibahas di sini.

Sales Tax Compliance for NYC Businesses

For businesses operating in NYC, compliance with sales tax laws is not optional—it’s a legal obligation. Failure to collect or remit tax can lead to audits, fines, and even criminal charges in extreme cases.

How to Collect and Remit Sales Tax NYC

Businesses must follow a clear process to remain compliant:

- Register with the NYS Tax Department.

- Collect the correct tax rate at the time of sale.

- Record all transactions with proper documentation.

- File periodic returns (monthly, quarterly, or annually).

- Remit the collected tax to the state.

Filing is done electronically through the NYS Tax Online Services portal. The system automatically calculates liabilities based on reported sales, though businesses must ensure accuracy in reporting.

sales tax nyc – Sales tax nyc menjadi aspek penting yang dibahas di sini.

Common Mistakes Businesses Make

Even experienced retailers can stumble on sales tax compliance. Common errors include:

- Applying the wrong tax rate (e.g., using 8% instead of 8.875%)

- Failing to collect tax on taxable services

- Not collecting tax from out-of-state customers who are in NYC temporarily

- Misunderstanding the clothing exemption (taxing items under $110)

- Not filing returns during low-sales periods

These mistakes can accumulate over time, leading to large liabilities during audits.

Audit Risks and How to Prepare

The NYS Tax Department conducts regular audits of businesses, especially those with high transaction volumes or inconsistencies in filing. To prepare:

sales tax nyc – Sales tax nyc menjadi aspek penting yang dibahas di sini.

- Maintain detailed records for at least three years.

- Use certified accounting or POS systems that automatically apply correct tax rates.

- Train staff on tax-exempt transactions and proper documentation.

- Conduct internal reviews before filing major returns.

“Many audits start with a simple discrepancy in reported sales versus bank deposits.” — NYS Tax Audit Division

Impact of Sales Tax NYC on Consumers and the Economy

The high sales tax rate in NYC has far-reaching implications for consumer behavior, business competitiveness, and municipal revenue.

Consumer Behavior: Tax Avoidance and Cross-Border Shopping

Due to the high tax rate, many NYC residents engage in cross-border shopping. They travel to nearby states like New Jersey or Connecticut to purchase big-ticket items like electronics, furniture, or cars where sales tax is lower.

For example, New Jersey’s base rate is 6.625%, and many items are exempt. This creates a competitive disadvantage for NYC retailers and reduces local tax revenue on certain goods.

sales tax nyc – Sales tax nyc menjadi aspek penting yang dibahas di sini.

Business Competitiveness and Pricing Strategies

NYC businesses must factor sales tax into their pricing and marketing strategies. Some absorb part of the tax to remain competitive, while others pass it fully to consumers.

E-commerce has leveled the playing field somewhat, as out-of-state sellers now collect tax, but brick-and-mortar stores still face challenges. Retailers in high-foot-traffic areas like Times Square or SoHo must balance rent, wages, and taxes to stay profitable.

Revenue Use: Where Does the Money Go?

The revenue generated from sales tax NYC funds critical public services:

sales tax nyc – Sales tax nyc menjadi aspek penting yang dibahas di sini.

- Public transportation (MTA operations and capital projects)

- Public education (city schools and programs)

- Sanitation and waste management

- Emergency services (police, fire, EMS)

- Capital infrastructure (bridges, roads, parks)

In fiscal year 2023, sales tax contributed over $12 billion to NYC’s budget, making it one of the largest revenue sources after income tax.

Future Trends and Potential Changes to Sales Tax NYC

As the economy evolves, so too does the sales tax landscape. Several trends and proposals could reshape how sales tax is collected and applied in NYC.

Potential Rate Changes and Political Debates

There is ongoing debate about whether the current 8.875% rate is too high, especially for low-income residents. Some policymakers advocate for reducing the rate on essential goods or expanding exemptions.

sales tax nyc – Sales tax nyc menjadi aspek penting yang dibahas di sini.

Conversely, others argue that sales tax is a stable revenue source needed to fund public services. Any change would require approval from both the state legislature and the governor, making reform difficult.

Digital Services and the Taxation of Streaming

As more consumers shift to digital services—streaming music, cloud storage, online courses—there is growing pressure to tax these “digital goods.” Currently, most digital services are not subject to sales tax in NYC, but this could change.

Several states have already implemented digital services taxes, and New York may follow. The NYS Tax Department has formed a task force to study the feasibility of taxing digital subscriptions and downloads.

sales tax nyc – Sales tax nyc menjadi aspek penting yang dibahas di sini.

Automation and AI in Tax Compliance

Advancements in AI and machine learning are transforming tax compliance. Modern point-of-sale (POS) systems can automatically apply the correct tax rate based on location, item type, and exemption rules.

For example, Square and Shopify POS systems integrate with tax engines like Avalara or TaxJar to ensure real-time compliance. This reduces errors and audit risks for small businesses.

What is the current sales tax rate in NYC?

sales tax nyc – Sales tax nyc menjadi aspek penting yang dibahas di sini.

The total sales tax rate in New York City is 8.875%. This includes 4% state tax, 4.5% city tax, and a 0.375% MCTD surcharge. This rate applies to most taxable goods and services, including retail purchases, restaurant meals, and car rentals.

Are groceries taxed in NYC?

No, unprepared groceries for home consumption are exempt from sales tax in NYC. This includes items like bread, fruits, vegetables, meat, and dairy. However, hot prepared foods, restaurant meals, and delivery orders are fully taxable at 8.875%.

Do online sellers have to charge sales tax in NYC?

Yes, online sellers must collect sales tax in NYC if they meet the economic nexus threshold: $500,000 in annual sales and 100+ transactions into New York State. Marketplace facilitators like Amazon are also required to collect tax on behalf of third-party sellers.

Is clothing taxed in NYC?

Clothing and footwear priced under $110 are exempt from sales tax in NYC. Items priced at $110 or more are subject to the full 8.875% tax rate on the entire price, not just the amount over $110.

How do I file sales tax returns in NYC?

Sales tax returns are filed electronically through the New York State Department of Taxation and Finance’s online portal. Businesses must register for a Certificate of Authority, collect tax, and file returns monthly, quarterly, or annually based on their sales volume.

Understanding sales tax in NYC is essential for both consumers and businesses. From the 8.875% composite rate to exemptions on groceries and low-cost clothing, the system is complex but navigable. Online sellers must comply with economic nexus rules, while tourists face additional taxes on hotels and car rentals. As digital services grow, future tax policy may evolve. Staying informed ensures compliance, saves money, and supports fair economic practices in one of the world’s most dynamic cities.

Further Reading: